Certainty Matters in Healthcare

Grocers are committed to providing a dependable, affordable, and competitive healthcare plan—one employees can count on when they need it most.

Until recently, outdated plan rules caused eligible employees to lose coverage for a week or more when they didn’t meet required work hours. For years, Grocers pushed for a solution, but progress was delayed. Only after taking decisive action in 2023 did we secure necessary improvements, ensuring continuous coverage starting January 1, 2025. Now, the Union has proposed to reintroduce uncertainty, making eligibility depend on hours worked every 12 weeks.

Grocers have kept healthcare affordable, maintaining low deductibles and out-of-pocket costs for full-time and part-time employees while absorbing rising expenses. Now, the Union proposes expanding comprehensive coverage for more part-time employees—increasing costs by up to 60%. Additionally, the Union demands Grocers continue paying unnecessarily high premiums to overfund plan reserves, which already exceed plan professional recommendations.

Certainty matters. Grocers have invested in Healthcare to provide long-term stability and lower employee expenses by maintaining premium costs, deductibles and other expenses. We remain committed to stable, reliable, and affordable healthcare for employees and their families.

Q: Are the Union claims true that Grocers simply want to spend down healthcare reserves so they can save money?

A: No. For many years, Grocers have made the necessary investments to ensure healthcare benefits remain funded with healthy reserves. In the current contract negotiations, Grocers proposals are based on guidance from independent healthcare plan professionals, jointly hired by both the Union and Grocers to provide fiduciary guidance. These experts have advised that current reserves exceed necessary levels.

Grocers are not proposing, nor would it be permitted, to remove funds currently invested in the plan. Instead, they have requested more analysis from plan professionals to determine what the new premium rates must be to maintain or enhance current benefits while preserving necessary reserves. Grocers invited the Union to participate in this request, however, the Union choose not to participate. Grocers requested new modeling for maintaining reserves at 15% and 30% above what plan professionals had deemed adequate.

Notably, during the 2023 contract negotiations, healthcare reserves were similar to current levels. However, the Union proposed diverting nearly $7.2 million in healthcare contributions over two years to fund their wage and retirement proposals—suggesting they believe plan reserves exceed what is necessary. This diversion was implemented in the 2023 union contract.

Q: Why are the Grocers proposing a percentage-based cost share model for premiums with its employees? Won’t this shift costs to your employees as the Union claims?

A: Grocers have covered 90% or more of premium costs in several of the recent negotiated contracts.

Grocers have proposed exploring a percentage-based cost-sharing model but have not been able to introduce specific details. We first needed the additional analysis from healthcare plan professionals, which we now have, and we are equipped to resume negotiations on this topic. The Union’s claim that this proposal would shift costs to employees is speculative and not based on facts.

As with all proposals, this will be guided by the Union’s stated priorities in bargaining and must be balanced with other factors—including wages, retirement, healthcare improvements, and other contract modifications—that also impact overall costs.

Our Commitment to Retirement

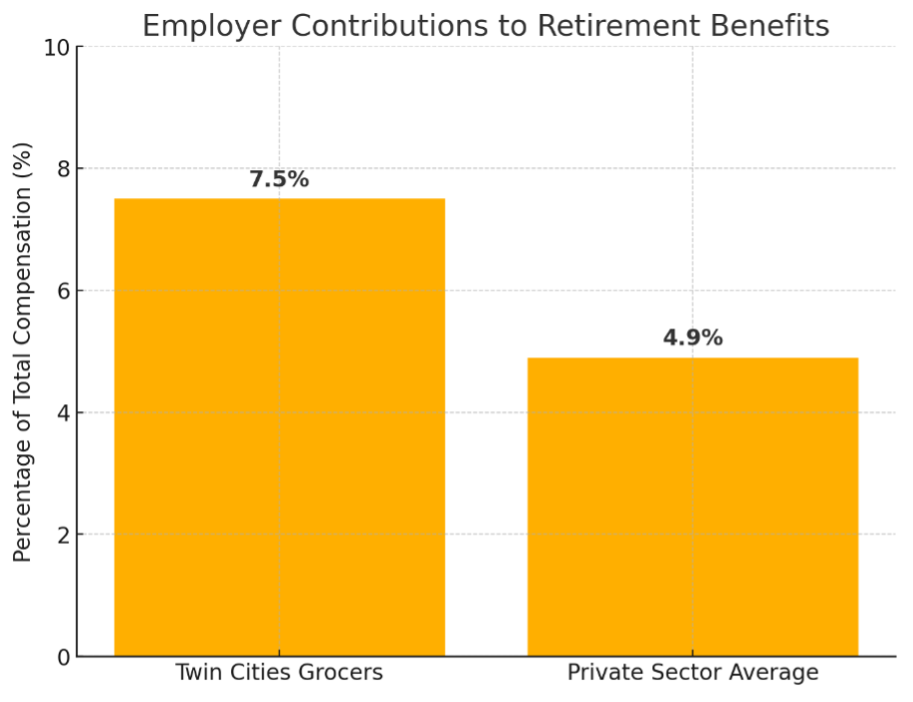

Your Twin Cities Grocers are proud to provide industry-leading retirement benefits, investing roughly 7.5% or more of total eligible wages into eligible employees’ retirement accounts last year. By comparison, according to the U.S. Department of Labor – Bureau of Labor Statistics (December 2024 New Release), private sector employers contributed an average of only 4.9% of total wages toward retirement benefits. This means our investment today is already substantially more than the national private-sector average.

Exhibit 1

Source: U.S. Department of Labor – Bureau of Labor Statistics (December 2024 News Release)

Grocers have long upheld their commitment to funding employee retirement benefits. Every grocer has employees—both active and retired—who have earned and rely on benefits from the UFCW 663 Minneapolis Retail Meat Cutters and Food Handlers Pension Plan, a plan that has faced significant financial challenges. To ensure long-term stability, grocers have transitioned nearly all employees to sustainable and secure retirement plans, such as a 401(k) plan or Variable Annuity Pension Plan. In addition to funding these new retirement accounts, grocers have never failed to meet their financial obligations under the former pension plan.

Despite these facts, the Union asserts that grocers must contribute more. The reality is that Twin Cities Grocers already provide retirement benefits that significantly exceed private-sector norms.

We remain deeply committed to ensuring our employees can retire with financial security, dignity, and peace of mind. Our strong investment in retirement benefits reflects our appreciation for our employees and our ongoing dedication to their long-term well-being.